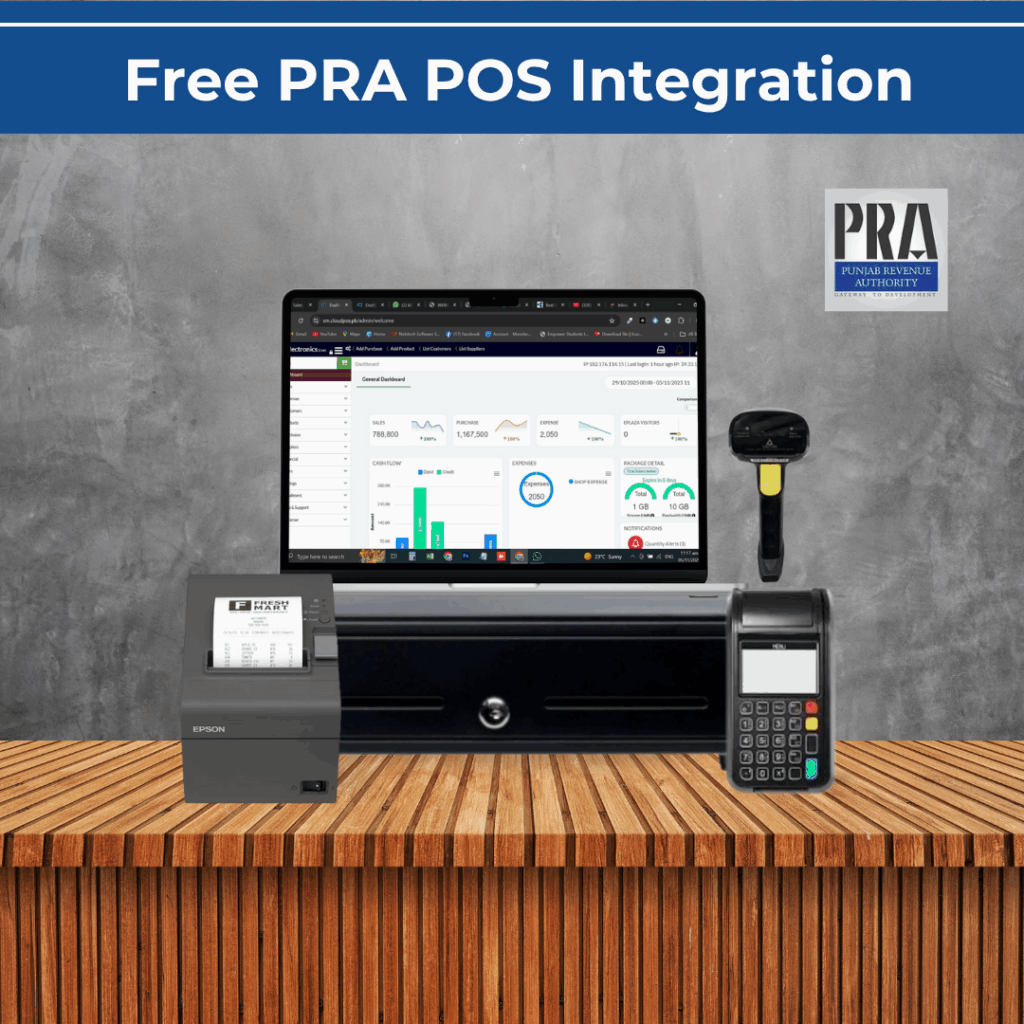

Integrate Your Free PRA POS with CloudPOS.pk

Are you struggling with Punjab Revenue Authority (PRA) tax compliance? CloudPOS is here to help! Take advantage of our free PRA POS integration services to simplify your tax management and ensure seamless compliance. With our expert team handling all the complexities, you can focus on growing your business without worrying about tax issues. Experience smooth, automated operations that keep your business ahead of the competition and fully compliant with PRA regulations.

With CloudPOS, managing your PRA taxes becomes a streamlined and efficient process. Our advanced POS integration automatically calculates and submits taxes, eliminating manual errors and reducing administrative workload. Every transaction is synchronized in real time, providing accurate tax reporting and ensuring that your business stays fully compliant. Our dedicated support team is always available to guide you, keeping you informed and updated with the latest PRA requirements.

Choosing CloudPOS is more than just integration it’s a commitment to your business’s growth and efficiency. We understand the challenges of PRA compliance, and our solution is designed to simplify them, saving you time, effort, and resources. From small retail shops to large-scale enterprises, our POS system ensures accurate invoicing, automated reporting, and reliable compliance across all operations. This allows you to focus on delivering excellent service and expanding your business.

Don’t let tax compliance slow your growth. CloudPOS empowers you with a stress-free, fully automated free Pra Pos integration Services tax management system that reduces risk, improves accuracy, and enhances operational efficiency. Join the growing number of businesses that trust CloudPOS for their PRA integration needs and take the first step toward seamless tax compliance. Start today and experience a smarter, faster, and more reliable way to manage your taxes with CloudPOS.

Key Features of Free PRA POS Integration with CloudPOS.pk

Frequently Asked Questions (FAQs)

We are here to answer your questions! This FAQ page covers a variety of topics, Regarding Free PRA POS and CloudPOS integration. If you have a question that is not answered here, please feel free to contact us.

What are the benefits of integrating PRA with CloudPOS?

Integrating PRA with CloudPOS automates all tax-related processes, from invoice generation to real-time submission. You can reduce manual errors, save time, and ensure full compliance with Punjab Revenue Authority regulations, allowing your business to operate smoothly and confidently.

How does this integration simplify tax compliance?

CloudPOS automatically synchronizes all sales and transactions with PRA in real time. This ensures accurate tax reporting, eliminates manual data entry, and reduces the risk of penalties or fines, making compliance seamless and hassle-free.

Can CloudPOS handle multi-location businesses?

Yes. Businesses with multiple outlets can maintain consistent operations and compliance across all branches. CloudPOS centralizes control over sales, inventory, and invoicing, ensuring every location adheres to PRA regulations effortlessly.

Is invoice generation automated?

Absolutely. CloudPOS automatically generates PRA-compliant invoices with barcodes or QR codes for every transaction. This streamlines sales processing, ensures accuracy, and provides a reliable digital record for audits and reporting.

Does this integration support wholesale and bulk operations?

Yes. CloudPOS efficiently handles high-volume sales and bulk transactions. It ensures that every sale is accurately reported to PRA, reduces administrative burdens, and simplifies tax compliance for wholesale and distribution businesses.

Can I track sales and tax reports in real time?

CloudPOS offers detailed reporting dashboards that allow you to monitor sales, tax submissions, and operational performance in real time. This empowers you to make informed decisions while maintaining complete transparency and accuracy.

How secure is my data with CloudPOS?

Data security is a top priority. CloudPOS employs advanced protocols to safeguard your financial and tax information. Every transaction and invoice is securely transmitted and stored, ensuring privacy and compliance.

Does this integration require internet connectivity?

CloudPOS works in both online and offline modes. Transactions can be processed even during temporary internet outages, and all data automatically synchronizes with PRA once the connection is restored, ensuring uninterrupted operations.

Which types of businesses can benefit from this integration?

Retail stores, grocery shops, restaurants, pharmacies, salons, e-commerce platforms, and wholesale distributors can all benefit. Any business required to comply with PRA regulations can simplify tax management with CloudPOS.

How can I get started with PRA POS integration?

Getting started is simple. Contact the CloudPOS support team to schedule your free PRA POS integration. Our experts guide you through setup, configuration, and onboarding, ensuring a smooth and hassle-free experience.

Industries That Can Integrate with FBR via CloudPOS.pk

Our goal at CloudPOS is to make PRA tax compliance effortless for your business. By integrating PRA POS with your existing systems, you gain complete control over your sales and financial records, ensuring real-time accuracy, transparency, and seamless tax reporting. No more manual entries, no more errors, just smooth, automated operations that keep your business compliant and efficient. Whether you manage a retail chain, a wholesale network, or an online store, this integration empowers you to maintain regulatory compliance while enhancing operational efficiency. Embrace the future of digital tax management with CloudPOS and experience a smarter, faster, and more reliable way to handle your invoicing and reporting processes.