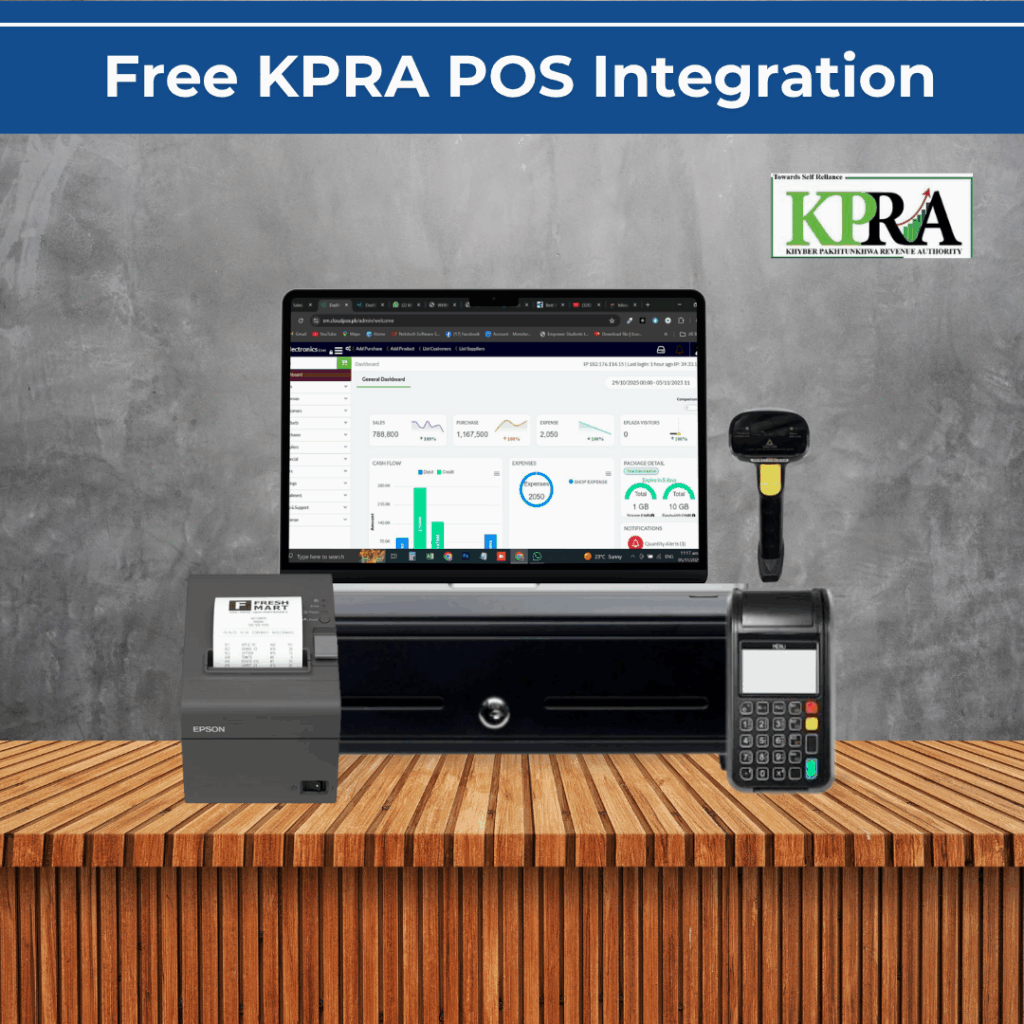

Integrate Your Free KPRA POS with CloudPOS.pk

Simplify KPRA Tax Compliance with CloudPOS.pk and eliminate the stress of managing complex tax obligations. Our free KPRA POS integration services allow businesses to automate every aspect of tax management while ensuring full compliance with the Khyber Pakhtunkhwa Revenue Authority (KPRA). Enjoy seamless tax operations, accurate reporting, and real-time synchronization so you can focus on expanding your business without worrying about manual entries or errors.

With CloudPOS, your tax compliance becomes fully streamlined. Every transaction, sales update, and invoice is automatically synchronized with free kpra pos integration services systems, ensuring precise tax calculations and submission. This automated approach reduces human errors, saves valuable time, and allows you to maintain accurate financial records effortlessly. Businesses can operate with confidence, knowing that their tax obligations are handled accurately and professionally.

Our team of experts is committed to providing continuous guidance and support, ensuring you remain updated with the latest free kpra pos integration services regulations and practices. CloudPOS empowers your business to stay compliant while enhancing operational efficiency. From automated barcode generation and QR codes to real-time sales documentation, our solution integrates seamlessly into your existing POS or ERP system, providing a reliable and hassle-free tax management experience.

Choosing CloudPOS as your free kpra pos integration services POS integration partner is an investment in long-term business growth. Whether you run retail chains, e-commerce platforms, restaurants, or SMEs, our solution simplifies your compliance processes, improves operational accuracy, and ensures your business thrives in a competitive market. Start your journey today and experience efficient, automated, and stress-free free kpra pos integration services tax management with CloudPOS.

Key Features of Free KPRA POS Integration with CloudPOS.pk

Frequently Asked Questions (FAQs)

We are here to answer your questions! This FAQ page covers a variety of topics, Regarding Free KPRA POS and CloudPOS integration. If you have a question that is not answered here, please feel free to contact us.

What are the benefits of integrating KPRA with CloudPOS?

Integrating KPRA with CloudPOS automates your tax compliance process. Your sales, invoices, and inventory are synchronized in real-time with the KPRA system, reducing errors, saving time, and ensuring full regulatory compliance for your business.

How does this integration simplify tax reporting?

The integration automatically calculates taxes for every transaction and generates KPRA-compliant invoices. All records are updated in real-time, allowing you to file accurate tax reports without manual entry or reconciliation.

Can I verify customer details through CloudPOS?

Yes. The system allows direct customer verification via KPRA, ensuring all transactions are properly validated. This enhances accuracy, regulatory compliance, and transparency in your operations.

Is the KPRA integration suitable for multi-location businesses?

Absolutely. CloudPOS centralizes data from all your outlets, providing real-time synchronization and uniform tax compliance across multiple branches, eliminating discrepancies and saving administrative effort.

What kind of reporting and analytics does CloudPOS provide?

CloudPOS offers detailed dashboards and analytics for sales, taxes, inventory, and customer data. These insights allow you to monitor performance, track compliance, and make informed business decisions.

Does the integration support different industries?

Yes. CloudPOS offers customized solutions for retail stores, restaurants, pharmacies, e-commerce platforms, and more. Each system ensures seamless KPRA compliance tailored to your specific industry requirements.

How secure is the data shared with KPRA?

Data security is a top priority. All information transmitted between CloudPOS and KPRA is encrypted and protected using industry-standard security protocols, safeguarding your business and customer information.

How easy is the setup process for KPRA integration?

The setup is straightforward. CloudPOS provides full support during integration, including configuration, training, and optimization, ensuring a smooth, hassle-free onboarding experience.

Can this integration handle large volumes of transactions?

Yes. CloudPOS is designed to efficiently manage high-volume sales, multiple SKUs, and frequent transactions while maintaining accurate KPRA-compliant records across all outlets.

Who can benefit the most from this integration?

Retail chains, wholesalers, e-commerce platforms, service providers, and SMEs can all benefit. Whether you run a single outlet or multiple locations, CloudPOS simplifies KPRA compliance and helps you focus on business growth.

Industries That Can Integrate with KPRA via CloudPOS.pk

At CloudPOS, our mission is to make KPRA tax compliance simple, reliable, and stress-free for every business. By integrating your POS system with CloudPOS, you benefit from real-time data synchronization, automated tax calculations, and clear, accurate financial reporting all within one powerful platform. Say goodbye to manual entries, compliance errors, and delayed submissions; our seamless system keeps your operations fully aligned with the Khyber Pakhtunkhwa Revenue Authority at every step.

Whether you run a small shop, a growing chain, or a multi-branch retail network, CloudPOS empowers you with complete visibility and control over your sales and tax data. Enjoy the confidence that comes with automated, secure, and error-free tax management. Step into the future of digital compliance and let CloudPOS enhance your accuracy, streamline your processes, and support your long-term business growth with ease.