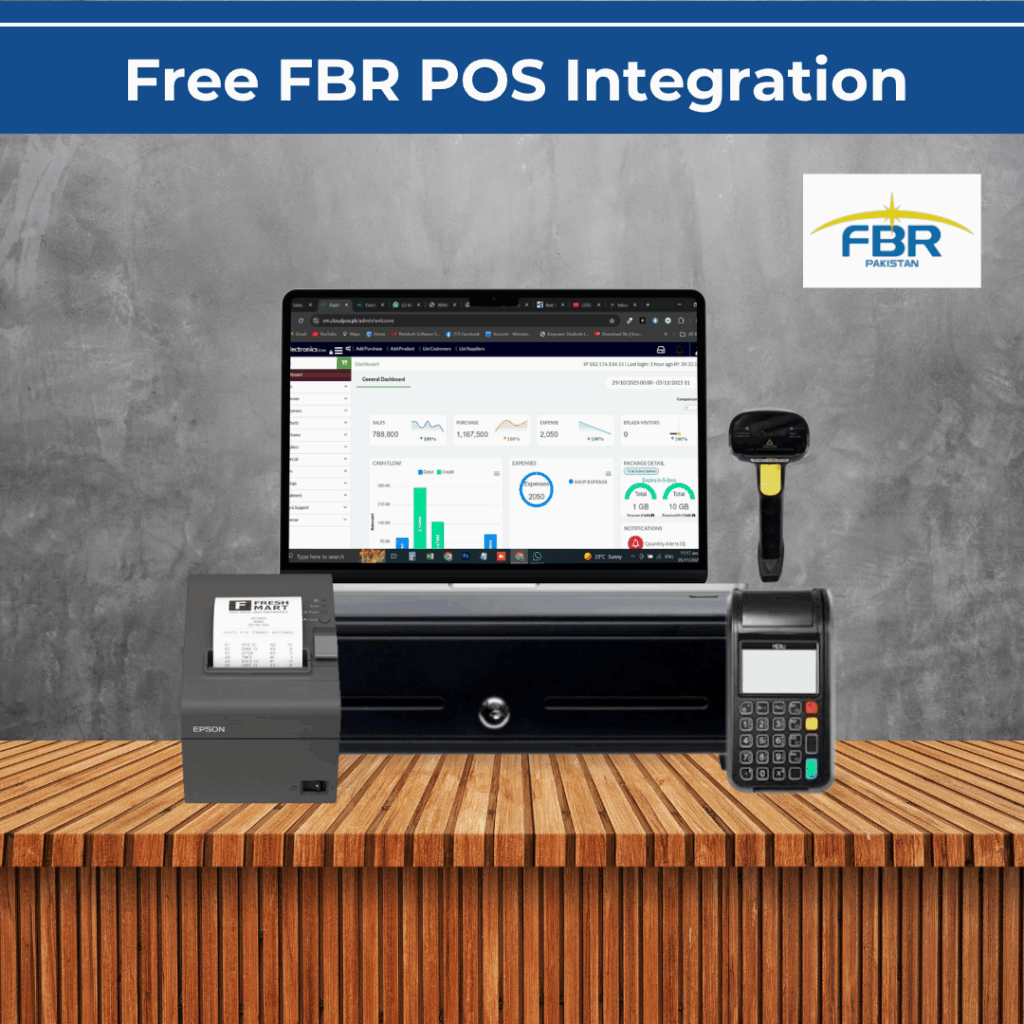

Free FBR POS Integration Services with CloudPOS.pk

Are you receiving notices and warnings from the FBR? Don’t let tax compliance challenges disrupt your business operations. With CloudPOS Free fbr pos integration Services, you can easily align your point-of-sale system with FBR regulations without stress or extra cost. Our expert team ensures a smooth, hassle-free integration that helps your business stay compliant while maintaining operational efficiency. Experience accurate, real-time tax reporting and enjoy peace of mind knowing that your compliance is always up to date.

Imagine running your business without the constant worry of FBR notices or penalties. CloudPOS makes that possible by enabling automated tax data synchronization directly with the FBR’s digital system. Each transaction is recorded and reported in real-time, ensuring complete accuracy and transparency. This eliminates the risk of manual errors and simplifies your tax management process. Focus on growing your business while we take care of the complex compliance requirements behind the scenes.

At CloudPOS, we believe in building long-term partnerships with our clients. Our dedicated integration experts work closely with your team to ensure that every step of the setup and compliance process runs smoothly. From onboarding to system updates, we provide continuous support and automatic FBR updates, keeping your POS system compliant with the latest regulations. With our proactive service, your business remains secure, compliant, and efficient always.

Don’t let tax compliance stand in the way of your success. With CloudPOS free FBR POS integration, you get more than just a solution you gain a trusted partner dedicated to helping your business thrive. Our system brings together automation, transparency, and reliability, freeing you from the burden of manual tax management. Join the growing community of businesses that trust CloudPOS to handle their FBR integration effortlessly and elevate their operations to the next level.

Key Features of Free FBR POS Integration with CloudPOS.pk

Frequently Asked Questions (FAQs)

We are here to answer your questions! This FAQ page covers a variety of topics, Regarding Free FBR POS and CloudPOS integration. If you have a question that is not answered here, please feel free to contact us.

What is Free FBR POS Integration?

Free FBR POS Integration by CloudPOS allows businesses to connect their Point of Sale (POS) systems directly with the Federal Board of Revenue (FBR). This ensures all sales are automatically reported to FBR in real time. The integration eliminates manual tax reporting, ensuring your business stays compliant, accurate, and efficient without extra costs.

Why is FBR integration important for my business?

Integrating with FBR through CloudPOS ensures your business meets legal tax compliance requirements while minimizing risks of penalties or notices. It helps you maintain transparency, simplifies tax filing, and gives you confidence knowing all your transactions are recorded securely and accurately in the FBR system.

Is the integration process complicated?

Not at all! The CloudPOS expert team handles the complete integration setup for you from configuration to live testing. Our free FBR POS integration service is designed for simplicity and speed. You’ll be guided step by step, ensuring your system is running smoothly and fully compliant in no time.

Can CloudPOS integrate with my existing POS system?

Yes, CloudPOS is designed to integrate with all major POS and ERP systems. Whether you’re using a custom POS, a retail software, or an accounting solution, our team can connect it seamlessly with FBR’s system. This flexibility ensures compatibility and efficient synchronization across your business operations.

What benefits do I get with this free integration?

With CloudPOS free FBR POS integration, you enjoy automated sales reporting, real-time tax submission, and error-free compliance. It saves you time, reduces manual work, and eliminates the stress of handling tax obligations manually. Plus, it enhances your operational transparency and builds trust with both customers and authorities.

Is my business data secure during this process?

Absolutely. CloudPOS uses advanced encryption and data security measures to protect all your financial and transactional data. Your information is transmitted through secure channels to the FBR system, ensuring compliance without compromising data privacy or system integrity.

Which types of businesses need this integration?

FBR integration is mandatory for various sectors including retailers, wholesalers, manufacturers, bakeries, textile shops, and large retail outlets. If your business deals with high-volume sales, bulk transactions, or high electricity consumption, this integration ensures you stay compliant with Pakistan’s FBR regulations.

How does this integration help avoid FBR notices?

By automatically syncing and reporting all sales data to FBR, CloudPOS eliminates the possibility of missed or inaccurate tax records. This reduces the risk of receiving notices or warnings from FBR. With real-time validation and reporting, your business remains transparent and fully compliant.

Does CloudPOS offer ongoing support?

Yes! CloudPOS provides continuous technical support and system updates to ensure your FBR integration runs smoothly at all times. Our dedicated support team assists with troubleshooting, updates, and compliance checks so you never have to worry about interruptions or non-compliance.

How can I get started with the free FBR POS integration?

Getting started is simple. Contact the CloudPOS support team or sign up through our website. We’ll help you set up your FBR integration quickly and guide you through every step from registration to real-time synchronization. Start today and experience stress-free compliance and business efficiency with CloudPOS.

Industries That Can Integrate with FBR via CloudPOS.pk

At CloudPOS, our mission is to simplify FBR compliance for businesses across Pakistan. By integrating your POS or ERP system with FBR through CloudPOS, you gain real-time visibility, automated tax reporting, and seamless digital invoicing. Say goodbye to manual data entry and compliance stress our solution ensures accuracy, transparency, and efficiency at every step. Whether you run a retail store, a wholesale operation, or a growing eCommerce business, CloudPOS empowers you to stay compliant effortlessly while focusing on your business growth. Experience smooth, secure, and fully automated tax management with CloudPOS your trusted partner for smart, compliant, and future-ready business operations.